|

||||

|

In this Update:

Senate Hearings on Proposed State Budget: Week Two

The Senate Appropriations Committee continued public hearings this week on the proposed 2022-23 state budget. Gov. Tom Wolf proposed a $45.7 billion budget that would increase spending by $4.5 billion. Based on projections, this will create a $1.3 billion deficit in the following fiscal year and produce a $13 billion deficit by 2026-27. Among the highlights: At the hearing for the Attorney General’s Office, committee members discussed concerns with state government’s cyber security infrastructure. Last year, a data breach involving a Department of Health contractor exposed tens of thousands of Pennsylvanians’ personal information to hackers. The hearing also covered the latest stats from the Safe2Say Something anonymous threat reporting system for schools, as well as Philadelphia’s skyrocketing homicide rate. At the hearing for the Department of Community and Economic Development, members stressed the need to improve Pennsylvania’s economic standing, noting that the current Corporate Net Income Tax rate has prevented many businesses from relocating and investing in Pennsylvania. You can find information on other budget hearings, hearing video, livestreams and more at PASenateGOP.com. Pennsylvania Acts to Support Ukraine

Pennsylvania has the second-largest population of Ukrainian Americans in the nation, with more than 122,000. Pennsylvania government is planning several responses to Russia’s invasion of Ukraine in order to deny funds to Russia and show solidarity with Ukrainians. Treasurer Stacy Garrity said the Treasury had started to divest its holdings in Russian-based companies. The Pennsylvania School Employees’ Retirement System is gathering details about its exposure to Russian-related investments and could divest in a few weeks. In addition, the Pennsylvania Liquor Control Board is reviewing its inventory and is expected to stop selling vodka made in Russia. To keep Russia in check in the long term, we must reassert America’s energy independence. Increasing domestic energy production and exports to European countries will go a long way toward reducing Russian influence and denying the regime the funds it needs to make war. Disabled Veteran Real Estate Tax Exemption

Pennsylvania veterans with a financial need who served during a period of war and are 100% disabled could benefit from a state real estate tax exemption program. An applicant whose gross annual income exceeds $95,279 will be considered to have a financial need for the exemption if allowable expenses exceed household income. You can find details about eligibility here. Contact your local County Veterans Affairs Director to apply for this program. I support expanding property tax relief for Pennsylvania’s disabled veterans and sponsored a bill with Sen. Elder Vogel (R-47) that received unanimous support from the Senate Veterans Affairs and Emergency Preparedness Committee. Senate Bill 578 is a constitutional amendment that would expand the state’s Property Tax Exemption program to the unmarried surviving spouse upon the death of an eligible veteran, provided that the State Veterans’ Commission determines such person is in need of the exemption. This measure also eliminates the “War Time” Clause so that the injury does not have to occur during a war for a veteran to be eligible for the exemption. Additionally, the legislation ensures that a veteran’s primary residence is still exempt while he or she is in a long-term care facility and excludes compensation for an injury from the calculation of income. The bill is before the full Senate for consideration. Setting up Shop in Downtown WaynesburgEmbroid’em opened its doors to family, friends, and elected officials for a ceremonial ribbon cutting this week. Owners Bethany and Tyler Tanner upgraded to a commercial space after starting a branding and marketing business out of their home. Nestled on West High Street in the heart of Waynesburg, Embroid’em is a small business to small business venture, helping others realize their branding potential through high quality embroidered apparel. Congratulations and best wishes as you continue to grow!

Pictured left to right: Mike Belding, Chairman on the Board of Commissioners for Greene County; Melody Longstreth, Executive Director at Greene County Chamber of Commerce; Tyler Tanner, Owner of Embroid’em; Bethany Tanner, Owner of Embroid’em; Representative Pam Snyder; Jeanine Henry, Waynesburg Prosperous & Beautiful and Community Bank; Greg Leathers, Waynesburg Mayor; and Matthew Mackowiak, Field Director, Congressman Guy Reschenthaler. Oh, the Places You’ll Go!

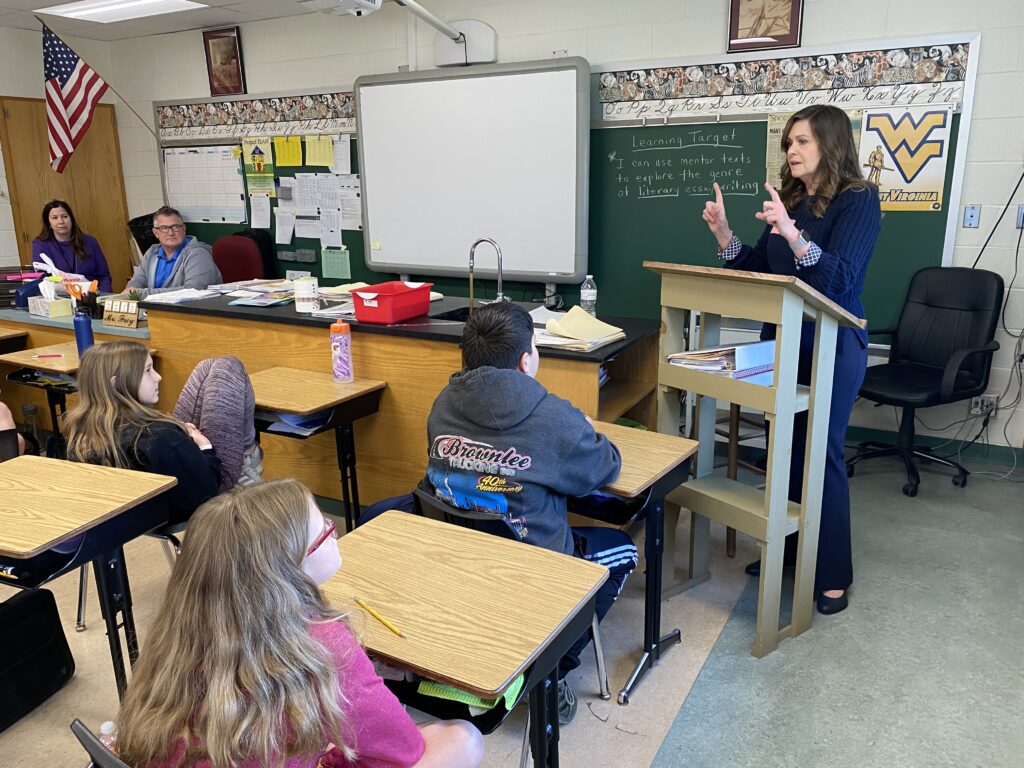

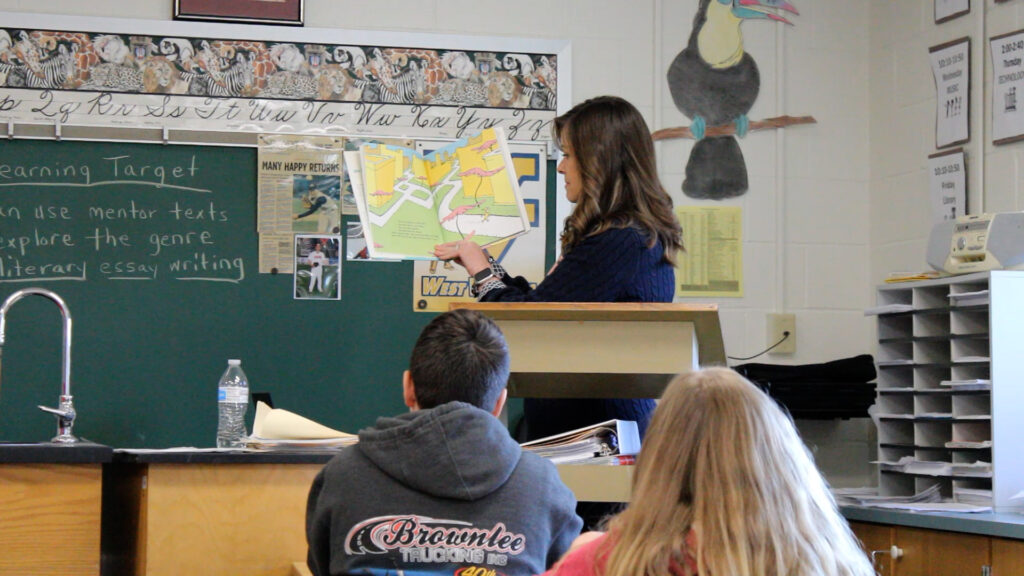

Wednesday was Read Across America Day and Dr. Seuss Day. I was invited to read the classic story, “Oh, the Places You’ll Go!” to a 4th grade and 5th grade class at Trinity North Elementary School in Washington. I had an absolute blast reading for the kids and was thrilled to tell them about what I do as a state senator. Keep reading! Assistance for Home Septic Repairs, Sewer Hook-ups

Low-interest loans are available to eligible Pennsylvania homeowners who need to repair or replace their on-lot septic system or connect to a public sewer. The assistance can help homeowners avoid or respond to municipal citations and improve the environmental health of their property. Loan terms are up to 20 years (up to 15 years for manufactured homes). There is no prepayment penalty if the loan is paid off early. The maximum loan amount is $25,000. The program is administered by the Pennsylvania Infrastructure Investment Authority, Pennsylvania Housing Finance Agency and Pennsylvania Department of Environmental Protection. You can find more information and terms here. PA ABLE Helps Families Save for Disability-Related Expenses

In 2016, the General Assembly passed the Achieving a Better Life Experience (ABLE) Act and created PA ABLE accounts that give individuals with qualified disabilities, their families and friends a tax-free way to save for disability-related expenses, while maintaining government benefits. Administered by the Pennsylvania Treasury, the accounts allow people with disabilities and their families the opportunity to save up to $100,000, without affecting eligibility for important government benefits, such as Supplemental Security Income or Medicaid. The withdrawals from the accounts for qualified expenses related to an individual’s disabilities are also considered exempt from federal and state taxes, and the accounts are not subject to Pennsylvania’s inheritance tax. To learn more about how you might be able to save money with the program, the Pennsylvania Treasury is hosting free webinars, with the next one for individuals with disabilities, families and professionals scheduled for Tuesday, April 19 from 6-7 p.m. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorbartolotta.com | Privacy Policy |