|

||||

|

In this update:

CNX Headquarters Providing Office Workspace for Nonprofits

This week I toured “The HQ at CNX” which provides office space at CNX Resources Corporation headquarters in Southpointe for nonprofit, charitable, under served, and underrepresented organizations for incredibly fair rental rates. This was also an opportunity to celebrate the organization TRPIL or “Transitional Paths to Independent Living,” as they moved into their new workspace at The HQ at CNX. TRPIL provides resources for integration, equality, and opportunity for people with disabilities. I’ve been a longtime supporter of TRPIL and love the work that CEO Shona Eakin, Joann Naser, and their staff do for our community. Shining a Light on a Dark IssueI have partnered with Senator Kristin Phillips-Hill to sponsor a resolution designating January 2023 as National Slavery & Human Trafficking Prevention Month. Although strides have been made, this insidious crime remains pervasive in the commonwealth. Here are my remarks about bringing awareness to this disturbing issue that takes place in our back yard: Voter ID: Time for PA to Catch Up with Other States, Nations

A proposed constitutional amendment passed by the Senate earlier this month to require ID verification at polling places remains in the House of Representatives. Its approval is needed to let voters have a say through a ballot question in the spring primary election. Every excuse used to block this rational election reform has been shown to be false. Requiring proof of identification before voting does not suppress turnout, and acceptable IDs are not difficult to obtain. Nationally, the calls for voter ID come from Democrats and Republicans alike. Eighty percent of Americans favor voter ID as do 74% of Pennsylvanians. Now is the time to pass Senate Bill 1 and let the voters decide. Here are my remarks from the floor on Senate Bill 1: Phase-out of Job-Killing PA Tax Begins

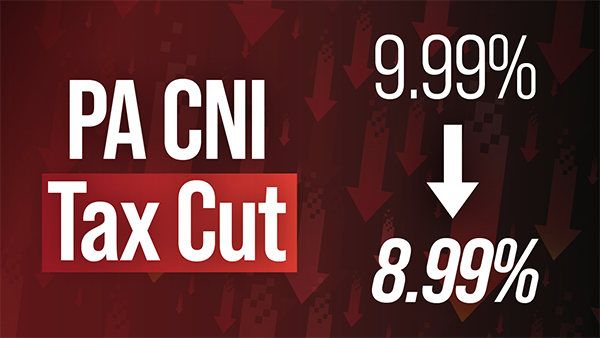

The phase-out of Pennsylvania’s sky-high Corporate Net Income tax got underway this month, part of our efforts to keep good jobs here and create new ones. Republican lawmakers secured a cut in this job-killing tax as part of the 2022-23 state budget. Before this reduction to 8.99%, Pennsylvania’s CNI tax had been 9.99% for nearly three decades while other states had lower tax rates – some far lower – and many have been lower for almost as long. When gradually reduced to 4.99% in 2031, Pennsylvania’s CNI rate will have gone from one of the highest in the nation to one of the lowest, making the commonwealth far more competitive with other states. A 2009 report by an economist at the Federal Reserve Bank of Kansas City demonstrates that the burden of the corporate income tax is borne in large part by labor within the state in the form of lower wages. A 2016 paper published in the journal American Economic Review found employees shoulder about a third of the corporate tax burden. Reducing this tax will be the difference between jobs coming to our local communities and jobs leaving. This will be a great benefit to Pennsylvania families. Rebates for Property Taxes and Rent Available to Seniors, Pennsylvanians with Disabilities

Older adults and Pennsylvanians with disabilities can apply now for rebates on property taxes or rent paid in 2022. The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in the claim year and meet all other eligibility criteria. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. You can find more eligibility and application information here. Eligible applicants can visit mypath.pa.gov to electronically submit their applications. Local Organizations Can Apply Now for Conservation Grants

Counties, municipalities and municipal agencies, pre-qualified land trusts, nonprofits and other eligible organizations can apply now for state conservation, recreation, trail and related grants. Administered by the Department of Conservation and Natural Resources, the Community Conservation Partnerships Program is funded with a variety of state and federal funding sources including Pennsylvania’s natural gas Impact Fee. Applications will be accepted through April 5. Online tutorials are available to aid organizations in the application process. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorbartolotta.com | Privacy Policy |